Why Traditional "Best Practices" Are Designed to Keep India's Middle Class Trapped in Mediocrity

I kept reading/writing about personal finance and then i realized that i am being pushed into mediocracy and i cant attain financial independence with this..

Before we jump in, here are some posts that led me here:

These are small chapters from my financial journey. What follows is the next.

My colleague had written these post on the “Best practices” and then i know we were all pushed in these stories and just being robbed by MFD, Insurance companies and so called financial institutions.

The system is built to keep you poor…. Real estate prices increases while the quality of life decreases for Indians. Now we need more money to live and the vicious circle keep on going..

let me tell you story of a middle class Indian….

Middle Class Financial Crisis

The article now opens with powerful visual evidence of India's middle-class struggles, including data visualization showing the stark divergence between stagnant earnings and rising inflation.

This chart illustrates the significant divergence between stagnant Indian middle-class earnings and surging food inflation from 2013 to 2024.

This chart perfectly illustrates your core argument about traditional financial advice failing the middle class, showing how food inflation nearly doubled while middle-class earnings remained flat.

The financial advice industry has created a systematic trap for India's struggling middle class. With household savings plummeting to 18.1% of GDP and 48% of families reporting declining earnings, the industry continues pushing "safe" strategies that guarantee wealth destruction through opportunity costs and inflation.

The Capital Crunch Reality: We're Already Broke

India's middle class faces an unprecedented squeeze that traditional financial wisdom completely ignores. The numbers are sobering:

48% of households report declining earnings

Average family adds ₹1 lakh in financial assets while taking on ₹53,000 in new liabilities annually

Real purchasing power has dropped by one-third over the past decade

When you're barely managing to save ₹50,000-₹1,50,000 annually after essential expenses, the last thing you need is advice designed for wealthy investors with surplus capital.

Income Stagnation Data

Added comprehensive income analysis across all economic cohorts to demonstrate the unique challenges facing the middle class.

Indexed income growth of low, middle, and high-income cohorts in India from 2012-13 to 2023-24, highlighting the stagnation of the middle-income group's earnings.

The Emergency Fund Lie: Your Money is Dying While You Sleep

Conventional Wisdom: Keep 6-12 months of expenses in savings accounts earning 2.5-3.5% while inflation runs at 5.5-6%.

Reality Check: This "safe" approach guarantees wealth destruction. For a family with ₹6 lakh in emergency savings, this strategy destroys ₹18,000-36,000 annually in purchasing power.

The Strategic Alternative: Credit Optimization

Key Strategy: Use credit card limits offering 45-55 days interest-free access for emergency liquidity. Personal loan rates now range from 10.49% to 24% across major lenders, making strategic credit utilization far superior to dead money parking.

Essential Educational Content:

Using Credit Cards for Emergency Funds - IndusInd Bank Insights

Article: Navigating Financial Emergencies with Credit Cards - Practical strategies for using credit as a financial safety net

Credit card emergency strategies - Practical guides from major banks

The Insurance Industry's Comprehensive Coverage Scam

The insurance lobby has convinced middle-class families that comprehensive coverage equals financial responsibility. This is corporate propaganda designed to extract maximum premiums from already constrained budgets.

The Truth: You need exactly two policies:

Health Insurance: High-deductible plans to protect against catastrophic medical costs

Term Life Insurance: Pure risk coverage to replace lost income for dependents

Everything else is premium extraction: ULIP, Home insurance, travel insurance, critical illness riders represent unnecessary complexity for families already capital-crunched.

Your Action Plan: From Complexity to Focused Wealth Creation

Step 1: Eliminate Wealth Destroyers

Emergency funds beyond one month of expenses

Overlapping insurance policies beyond health and term

Multiple mutual funds with similar portfolios

ULIPs combining poor insurance with worse investment returns

Step 2: Generate Alpha Through Active Management

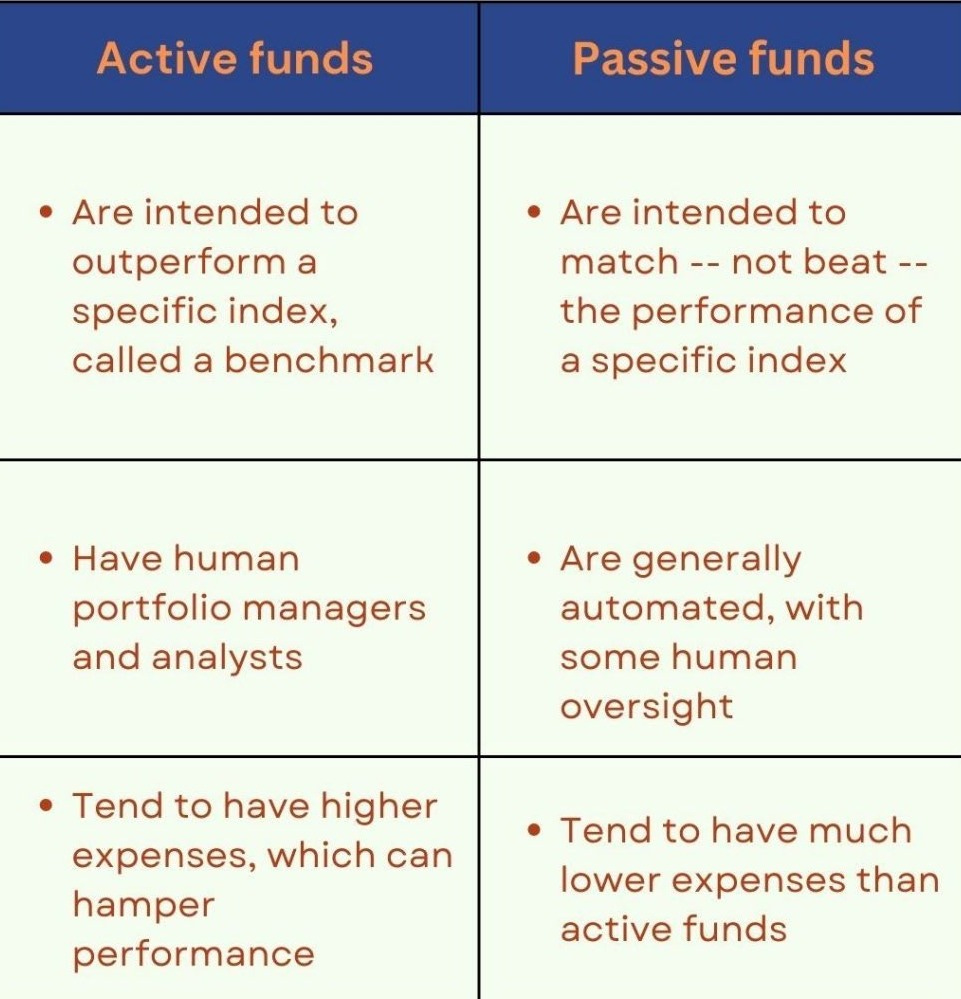

The Active management can be through Direct Equity, Mutual Funds, AIFs, PMS, or Other Active Strategies that can generate alpha for you with risk in control

While financial advisors promoted passive index investing, active fund managers who understood alpha generation delivered life-changing returns.

2024 Performance Massacre Data:

Motilal Oswal Midcap Fund: 57.47%

Motilal Oswal ELSS Tax Saver Fund: 46.55%

Invesco India Midcap Fund: 43.22%

Bandhan Small Cap Fund: 42.31%

The alpha generation advantage: Approximately 70% of equity mutual funds outperformed their benchmarks in 2024.

NSE India's "Active vs Passive Investing" series - Comprehensive breakdown covering tracking error, performance analysis, and decision frameworks

Warren Buffett concentration strategy videos - Multiple expert analyses of his portfolio philosophy

HSBC Navigate series - Professional insights on strategy complementarity

Markets by Zerodha - India’s household debt is rising—spurred largely by personal, credit-card, and gold loans, yet remains lower than emerging-market averages.

The Bottom Line: Choose Financial Liberation

The choice facing India's capital-crunched middle class isn't between risk and safety—it's between conscious wealth creation and unconscious wealth destruction.

With household debt rising to 43.5% of GDP and 48% of families reporting declining earnings, the cost of playing it "safe" has become survival borrowing instead of wealth creation.

Your financial liberation requires three fundamental shifts:

Reject fear-based emergency fund parking that guarantees wealth destructionChoose focused alpha generation over diversified mediocrityOptimize credit strategically instead of avoiding all debt

This content is for educational purposes only. Always consult with a qualified financial advisor before making investment decisions.