The Day I Almost Bought a ULIP — And Why You Shouldn't Either

How I Nearly Fell for a Fancy-Sounding Investment — and What ₹1 Lakh in Charges Taught Me About Financial Products.

It was a random day, and I had just finished my work. I was scrolling through my inbox when a subject line caught my eye:

“Get the Best of Both Worlds: Insurance + Investment with Just One Plan!”

I clicked it. The words sounded smart. Efficient even. As a 20-year-old CFA Level 1 candidate, currently doing a research internship and earning ₹15,000 a month, I thought I was getting financially smarter every day.

But sometimes, a little knowledge is a dangerous thing.

A Flashback to the Mistake That Almost Happened

The plan being pitched was a ULIP—Unit Linked Insurance Plan. I’d heard the term before, but never really looked into it. I started reading.

Insurance + Investment? Sounds amazing, right? The more I read, the more it felt like I was reading about a financial superweapon:

Life insurance

Market-linked returns

Tax benefits

Assured bonuses

All-in-one package!

And it wasn’t just the email. A few days later, a well-dressed executive from a bank called me. He had somehow found my number (I still don’t know how) and pitched a “5-year ULIP with assured returns, tax benefits, and bonus top-ups”. He made it sound like it was a gift from the financial gods.

But something didn’t sit right. I remembered my earlier struggles trying to understand insurance. If you’ve read my insurance blog, Health and Life (you should if you haven’t), you’d know how confusing that journey was, conflicting advice, hidden clauses, and the terrible realization that my friend had once been sold an endowment plan disguised as “investment”.

So, this time, I paused. I dug deeper.

What I Found Will Shock You

That night, while sipping cold coffee and hunting for clarity, I stumbled upon this Zero1 by Zerodha video on ULIPs.

Honestly? It opened my eyes.

ULIPs are often pitched as “the best of both worlds.” But in reality, they are the worst of both:

High Commissions: ULIPs can pay 15–35% commissions to agents in the first year alone. That’s your money going straight to someone else.

Poor Insurance Cover: Most ULIPs offer insurance of 10x the premium. So if you’re investing ₹50,000 a year, your cover is just ₹5 lakhs. That's barely enough to cover hospitalization today, let alone protect your family.

Confusing Structure: Part of your premium goes into investment, another into charges, and a tiny part into insurance. It's like ordering a thali and getting a single roti, half a bowl of dal, and being charged for a buffet.

Where Does Your ULIP Premium Go?

ULIPs look shiny on the outside, but underneath, they're packed with charges. Here’s where your money goes:

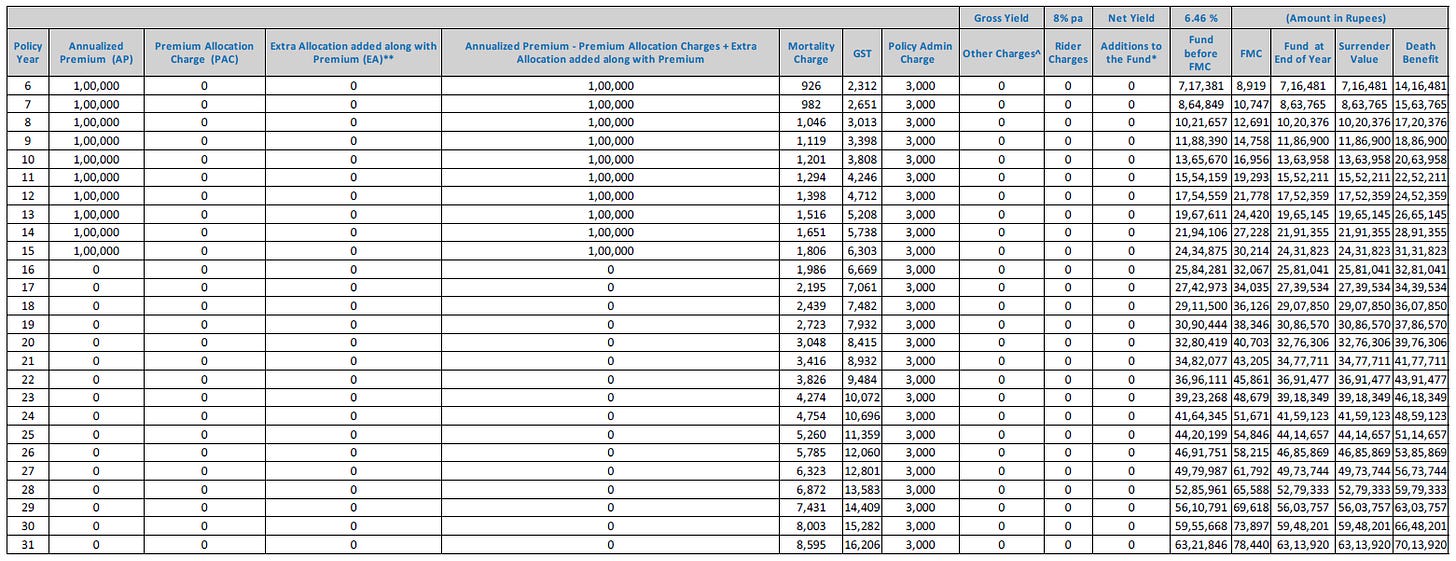

Case Study: Tata AIA Smart SIP ULIP

Annual Premium: ₹1,00,000

Policy Term: 31 years

Premium Payment Term: 15 years

Sum Assured: ₹7,00,000 (7x of annual premium)

Fund Allocation:

50% Multi Cap Fund (High risk)

50% Flexi Growth Fund II (High risk)

GST Rate: 18%

Fund Management Charges + Admin in Year 1: ₹4,289

Mortality Charge Year 1: ₹752

GST on Charges (Year 1): ₹907

Net Invested in Year 1: ₹1,01,807 - (₹4,289 + ₹752 + ₹907) = ₹95,859

Where Did ₹1,00,000 Go in Year 1?

ULIP Charges Breakdown — Year 1 (Actual)

Policy Admin Charge: ₹3,000

Fund Management Charge (FMC): ₹1,289

Mortality Charge: ₹752

GST on Charges: ₹907

Total Charges: ₹5,948

So, ₹5,948 of your money vanished before even entering the market, and this increases every year as charges grow with fund value.

Long-Term Impact (At 8% CAGR)

If you pay ₹1,00,000 annually for 15 years (total ₹15 lakh), your projected maturity value at 8% return is ₹63.13 lakh after 31 years.

But wait — you paid ₹15 lakhs over 15 years. And it grew out to just ₹63L after 31 years?

A plain SIP in an index fund (12% CAGR) could give you more than ₹1 crore with the same investment. With ULIP, your returns are kneecapped by:

Mortality Charges (every year)

Policy Admin Charges

Fund Management Charges (FMC)

GST on Charges

Zero flexibility (you can’t switch AMCs)

Why This Matters

This isn’t theory. It’s real paperwork from a real policy.

You start with ₹1 lakh, and by Year 1, ₹5,944+ is gone. The rest barely earns because returns are eaten up by non-transparent costs.

If this policy were sold to a 25-year-old hoping for wealth + protection, it's a poor deal. They're getting:

Less than ideal insurance (₹7 lakh cover)

Mediocre returns (≤8% with high risk)

No liquidity (5-year lock-in, charges on exit)

ULIP Breakdown: Tata AIA Smart SIP – Goal Secure

Premium: ₹1 lakh/year

Policy Term: 31 years

Investment Funds: Multi Cap + Flexi Growth Fund II (high risk)

Actual Invested (after all costs Year 1): ₹97,960

Death Cover: ₹7 lakh only

Even at 8% return, after 31 years the maturity value is just ₹63 lakh. A SIP in index funds could get you over ₹1 crore with the same money.

And that’s why I always say:

Buy Term. Invest the Rest.

ULIPs are built for agents. Not for you.

ULIP Lock-in: The Catch No One Tells You

Sure, mutual funds have some lock-ins too (like ELSS). But with ULIPs:

Your money is locked for 5 years minimum

If you exit before that, surrender charges can destroy your capital

You can’t switch AMCs if the ULIP fund underperforms (a huge disadvantage)

You’re stuck with whatever fund house your insurer offers

So even if your ULIP’s equity fund performs worse than a regular Nifty index fund, you can’t escape.

This is what Zero1’s video nails beautifully:

“In a ULIP, you can switch between decks—but you’re still on the same sinking ship.”

ULIP vs Term + SIP: A Reality Check

Let’s say you're 25, healthy, and investing ₹1,00,000 per year.

Bottom line?

Better coverage

Higher returns

More flexibility

You’re essentially overpaying for subpar insurance and underperforming investments.

Real Numbers: 20-Year Term vs ULIP

Let’s assume two people:

Person A buys a ULIP: ₹1 lakh/year for 20 years

Person B buys term insurance (₹500/month) and invests ₹94,000/year in index funds (12% CAGR)

Results:

Person A (ULIP): Gets ₹50–60 lakhs + ₹10–25L cover

Person B (Term + SIP): Gets ₹90+ lakhs + ₹1 crore cover

Who’s smarter?

The Psychology of ULIP Sales

Why do people fall for ULIPs?

The convenience trap — “One plan does it all.”

The tax trap — “80C and tax-free maturity.”

The fear trap — “What if I die without insurance?”

The pressure trap — “Sir, this is a limited-time offer.”

But none of these justifies locking into a costly, underperforming product for decades.

If you really want peace of mind, go with clarity and flexibility, not complexity.

Most People Don’t Even Know They Own a ULIP

My cousin thought she had a SIP.

Turned out she’d been investing in a ULIP for 7 years — thinking it was a mutual fund. Her bank executive never explained the mortality charges, allocation deductions, or the surrender penalty.

Sadly, this story is extremely common. And that's where services like Ditto Insurance come in; they’ll help review your policy for free, without upselling you something worse.

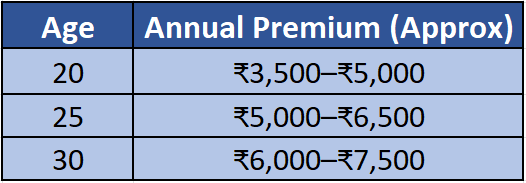

Why Term Insurance Is Better — Always

Here's what a ₹1 crore term plan looks like:

You pay a tiny premium to protect your loved ones — that’s it. No bells, no bonuses, just pure peace of mind.

ULIPs Still Sell Because...

Year 1 commissions are 15–35% — ₹15K to ₹35K of your money goes to the agent

Complex terms and illustrations make them hard to compare

Words like “assured bonus”, “maturity benefit”, “tax-free” blind most people

Lock-in makes it hard to exit — even when you realize it’s underperforming

Did you know?

In FY23 alone, Indians paid ₹1.17 lakh crore just in commissions on life insurance — that’s more than our government’s education budget!

Source: Pranjal Kamra on LinkedIn

The Ugly Truth No One Tells You

Here's the scary part: Most people don’t even know they’ve bought a ULIP. They just trusted their banker or insurance agent and signed on the dotted line. One of my cousin sisters had a policy for 7 years and still thought it was a SIP.

If you’re unsure whether you or your parents were mis-sold a policy, I recommend checking with a professional.

What Should You Do Instead?

This was the biggest lesson I learned: Insurance is not an investment. Investment is not insurance. Treat them separately.

Here’s what I now recommend to anyone just starting like me:

Buy a Term Insurance Plan

Pure protection. No returns. But that’s the point.

You can get a ₹1 crore cover for as little as ₹400–600/month if you're young and healthy.

Invest in Direct Mutual Funds

Clear, transparent, low-cost.

Easy to track and manage. You know what you’re paying for.

By separating these, you have control, transparency, and efficiency. And that’s how you build real wealth and security.

So Should You Ever Buy a ULIP?

ULIPs can make sense if:

You're undisciplined and need forced savings

You're in the highest tax bracket and want 10(10D) benefits

You're comfortable with lower returns + medium coverage

But for most people, especially young earners like me?

ULIPs are a NO.

Term + Direct Mutual Funds is the winning combo.

My Strategy as a 20-Year-Old Analyst

With only ₹15,000/month as a stipend, here's how I personally manage:

₹500/month – Term life insurance (₹1 Cr cover)

₹7,000/month – SIP in index funds

₹1,000/month – Emergency fund via liquid fund

Learning and experimenting with a small-cap mutual fund (₹500/month)

Reviewing insurance annually (through Ditto or directly)

I now know what I own, why I own it, and what it costs me. That’s financial literacy in action.

Lessons from My ₹15,000 Stipend

As a 20-year-old just starting out in finance, every rupee matters to me. I can’t afford to throw money into a financial product that’s built more for the agent than for me.

ULIPs might work for some, but they are rarely the best choice for a young investor with limited capital and long-term goals.

So if you’re reading this, take a step back before buying any product that sounds too “perfect.”

And if a bank ever says, “Sir, this is a limited-period ULIP with guaranteed returns,”… just smile and walk away.

Let’s keep learning. Let’s stay smart. And let’s never stop asking questions.

-Mudra Dave